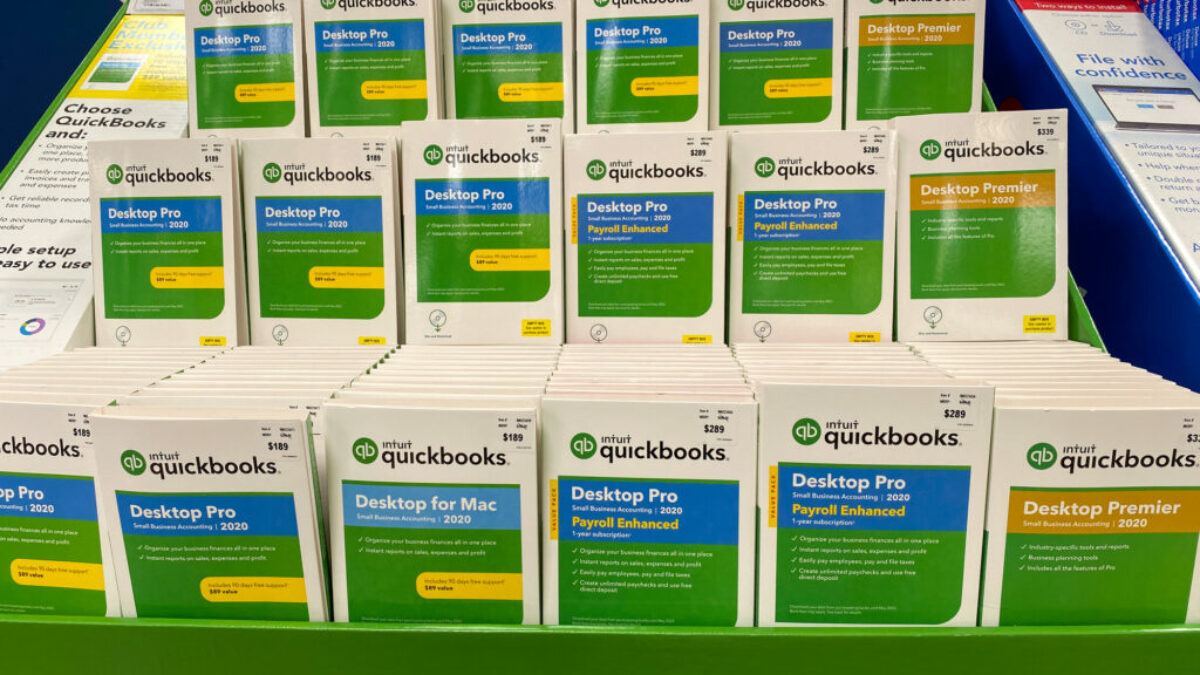

Past that issue, though, you are welcome to continue using your version of QuickBooks for years to come.Īs an important side note, and for the sake of your accountant, we recommend you still upgrade your QuickBooks regularly, even if it isn’t every three years. This means that if your particular version of QuickBooks is more than three years old and you run in to any technical issues, you most likely will not receive any support directly from QuickBooks itself. If you do not use these additional services you are not required to upgrade at any specific point in time, but it is important to note that QuickBooks is only supported for three years by Intuit.

If you do not upgrade your QuickBooks software and you use these or other additional services, they will no longer be available to you until you process the upgrade. We usually recommend that at least for the payroll processing service you upgrade before the end of May to make sure your payroll service is not interrupted. For example, if you purchased a 2013 version of QuickBooks, you will need to upgrade to the 2016 version. If you are using any of the additional services such as credit card processing, emailing invoices through the QuickBooks server, or processing payroll in QuickBooks you will be required to update your QuickBooks software every three years.

The answer to this can depend on the different additional services in QuickBooks you may or may not be using. Do you have an older version of QuickBooks and wonder when the right time would be to upgrade to the newest version? A common question related to QuickBooks is whether or not you are required to upgrade your QuickBooks software and, if so, how often the upgrade should occur.

0 kommentar(er)

0 kommentar(er)